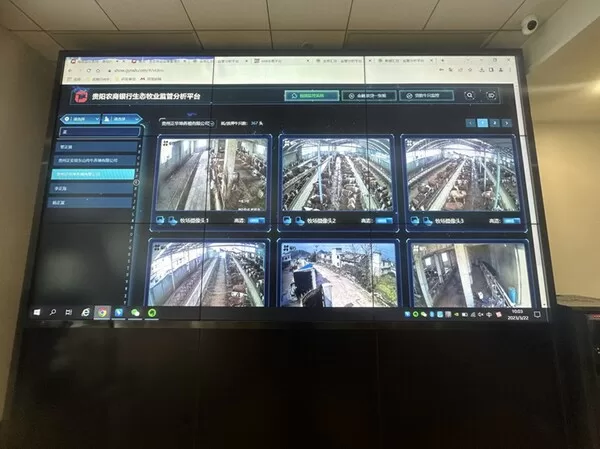

GUIYANG, China, May 27, 2023 — A news report by Huanqiu.com: Guizhou is writing a new chapter of rural revitalization via the integration of big data and agriculture. Each…

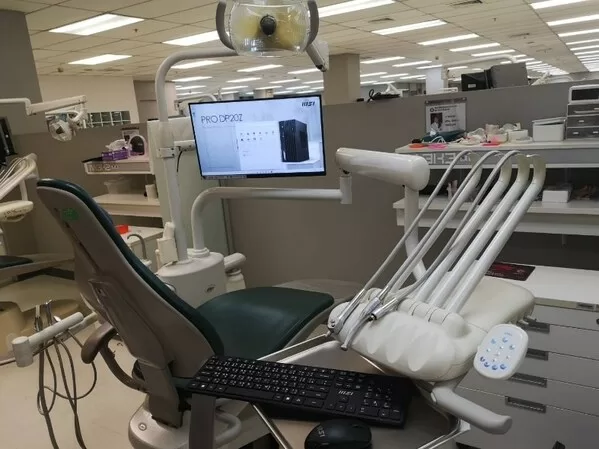

Unleashing Success in Vertical Market: MSI PRO Desktop, All-in-One PC, and Business Monitor Deliver Unrivaled Reliability and Performance for Businesses

TAIPEI, May 27, 2023 — At Computex 2023, MSI will showcase the latest lineup of professional computing solutions for Business, including the digital signal usage for MSI PRO DP10 13M,…

CGTN: China-DRC ties enter comprehensive, deep-going growth with full vitality

BEIJING, May 27, 2023 — In 2015, China and the Democratic Republic of the Congo (DRC) established a strategic partnership of win-win cooperation, which provided a strategic direction for the…

Big data expo opens in SW China, highlighting latest achievements

GUIYANG, China, May 27, 2023 — The China International Big Data Industry Expo 2023 kicked off on Friday in Guiyang, capital of southwest China’s Guizhou Province, showcasing the country’s latest…

Hanersun Ranked as a Tier 1 PV Module Manufacturer with its 600W+ Technology

NANJING, China, May 26, 2023 — This week, the world-renowned BloombergNEF (BNEF) announced the Tier 1 list (a first-class PV module manufacturer) for the second quarter of 2023. Hanersun has…

Chinese city lures talent and firms with lavish perks

QUZHOU, China, May 26, 2023 — This is a report from China.org.cn Quzhou, a city in eastern China, is offering generous rewards to lure top enterprises and high-quality talent…

Deltek Reaches Agreement to Acquire Replicon, A Global Provider of Knowledge Workforce Management Solutions for Project and Service-Centric Organizations

HERNDON, Va., May 26, 2023 — Deltek, the leading global provider of software and solutions for project-based businesses, announced today that it has entered into an agreement to acquire…

Acer Unveils its First Eco-Friendly Wi-Fi 6E Mesh Router Made with PCR Materials

Acer Connect Vero W6m hits peak speeds of up to 7.8 Gbps with tri-band AXE7800 throughput while featuring 30% PCR plastic in…

Tuniu to Report First Quarter 2023 Financial Results on June 9, 2023

NANJING, China, May 25, 2023 — Tuniu Corporation (NASDAQ:TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced that it plans to release its…

G-P Named Employer of Record Industry Leader in The IEC Group Global EOR Study 2023

G-P recognized for its innovative technology, exceptional customer experience and well-established expertise in the global research firm’s inaugural report REMOTE FIRST COMPANY,…