SANTA CLARA, Calif., June 1, 2023 — Dispelix, a leading see-through waveguide developer for XR, together with Avegant, a renowned developer of miniaturized LED light engines, are excited to…

China Telecom Global and stc group ink MOU to collaborate in IoT and Connected Car Projects

Leveraging their respective IoT expertise to accelerate the development of connected car technology in Saudi Arabia HONG KONG, May 31, 2023 — On 19th of April, China Telecom Global Limited…

Waterdrop Inc. Announces Earnings Date Change: First Quarter 2023 Earnings Release Scheduled June 2, 2023

BEIJING, May 31, 2023 — Waterdrop Inc. (NYSE: WDH) ("Waterdrop" or the "Company"), a leading technology platform dedicated to insurance and healthcare service with a positive social impact, today announced…

NTT SECURITY HOLDINGS 2023 GLOBAL THREAT INTELLIGENCE REPORT REVEALS ALARMING BLURRED LINE BETWEEN CYBERTHREATS AND REAL-WORLD IMPACT

Report contains global attack data collected and analyzed from January 1, 2022, to December 31, 2022. TOKYO, May 31, 2023 — From the…

Trip.com Group to Hold Annual General Meeting on June 30, 2023

SHANGHAI, May 30, 2023 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged tours…

ABPCyber Unveils Cutting-Edge Cyber Fusion Centre, Ushering in a New Era of Cybersecurity Excellence and Global Expansion

SINGAPORE, May 30, 2023 — ABPCyber, the premier cybersecurity service provider in Southeast Asia and subsidiary of ABPGroup, announced the inauguration of its state-of-the-art Cyber Fusion Centre. This momentous…

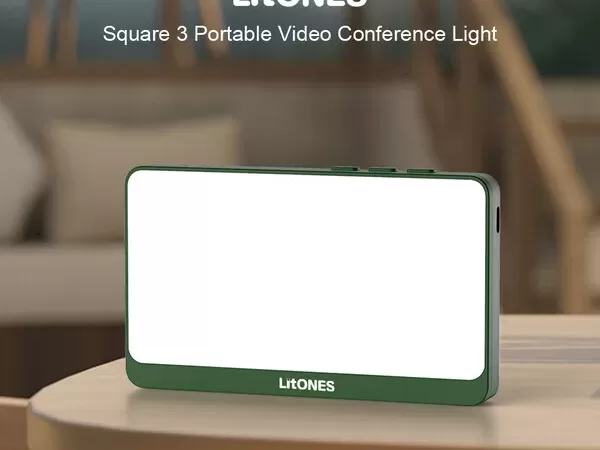

LitONES Launches Square 3 Portable Video Conference Light on Kickstarter, Revolutionizing the Way Professionals Approach Online Meetings

The world’s first portable business-oriented conference light/Comfortable Sunshine-like Lighting LOS ANGELES, May 29, 2023 — As remote work and hybrid offices continue to dominate the business world, video conferences…

BEST Inc. Publishes 2022 ESG Report, Driving Green Logistics through Digitalization

HANGZHOU, China, May 29, 2023 — BEST Inc. (NYSE: BEST) ("BEST" or the "Company"), a leading integrated smart supply chain solutions and…

Big Data Expo 2023: Merging Digital Technology with Culture

GUIYANG, China, May 28, 2023 — A news report by Huanqiu.com: The much-awaited Big Data Expo 2023, taking place from May 26th to 28th in Guiyang, presents an array…

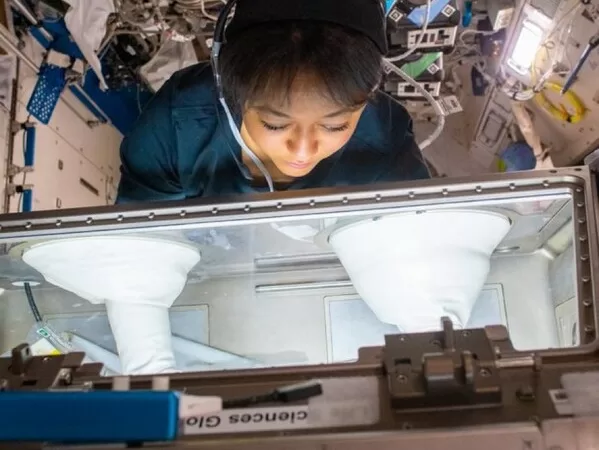

Inspiring a new generation of scientists: 12 thousand Saudi students collaborated with the astronauts in three scientific experiments

CAPE CANAVERAL, Fla., May 27, 2023 — In a rare educational motivational event, the two astronauts Rayyanah Barnawi and Ali AlQarni conducted three educational awareness experiments from the International…