Businesses and workers call for greater flexibility, questions raised over the hours-based contract, and a new empathetic leadership profile emerges ZURICH, June 30, 2020 — Workers demand greater flexibility after coronavirus, with a 50/50 split of remote and office time confirmed as…

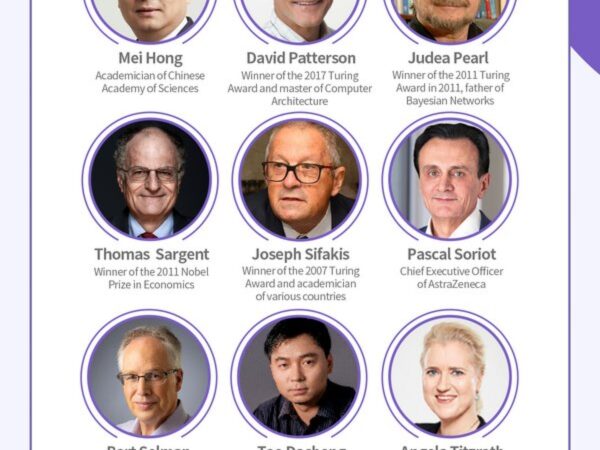

The World Artificial Intelligence Conference 2020 Opening on July 9 with Visitor Registration Available Now

SHANGHAI, June 30, 2020 — Hosted by the Shanghai municipal government, the World Artificial Intelligence Conference (WAIC 2020) is opening to the public from July 9 – 11 in Shanghai, China, with registration now open for visitors. Under the theme of "Intelligent Connectivity, Indivisible Community," the annual conference is set to…

Optoma Unveils Award-Winning P1, 4K UHD Laser Cinema For her 20th anniversary

TOKYO, June 30, 2020 — Optoma officially unveils Award-Winning P1, 4K UHD Laser Cinema, now shipping its Optoma P1 available for Pre Order in Japan for her 20th anniversary. Optoma, a leading international projector and audio solution brand, has reached an exciting milestone as the company celebrates 20 years of delivering…

X Financial Reports First Quarter 2020 Unaudited Financial Results

SHENZHEN, China, June 30, 2020 — X Financial (NYSE: XYF) (the "Company" or "we"), a leading technology-driven personal finance company in China, today announced its unaudited financial results for the first quarter ended March 31, 2020. First Quarter 2020 Financial Highlights Net revenues decreased by 31.9% to RMB529.0 million…

Clarivate Releases Web of Science Journal Citation Reports to Identify the World’s Leading Journals

2020 edition enables research community to make decisions with confidence using new data on open access models and updated journal self-citation parameters LONDON and PHILADELPHIA, June 30, 2020 — Clarivate Plc (NYSE:CCC), a global leader in providing trusted information and insights to accelerate the pace of innovation, today released the 2020 update…

Locus Listed as a Representative Vendor in Gartner’s Market Guide for Vehicle Routing and Scheduling

The Company was recognized as a Representative Vendor in the 2020 report WILMINGTON, Delaware, June 29, 2020 — Locus, a global B2B SaaS company that automates human decisions in the supply chain, today announced that it has been identified as a Representative Vendor…

Tuniu Has Regained Compliance with Nasdaq’s Minimum Bid Price Requirement

NANJING, China, June 29, 2020 — Tuniu Corporation (Nasdaq:TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced that it received a notification letter (the "Compliance Notice") from the Listing Qualifications Department of the Nasdaq Stock Market Inc. ("Nasdaq") dated June 26, 2020, indicating that…

D-Link 5G Solutions Revolutionize Mobile Connectivity

D-Link’s 5G products DWP-1020, DWR-978, and DWR-2101 connect the world of tomorrow TAIPEI, June 29, 2020 — D-Link today announced their new 5G solutions that create a world of wireless possibilities whether at home, at the office, or on the go. 5G networks elevate mobile internet connectivity and enhance IoT…

Carry Begins Offline Data Collection Campaign with South Korea’s largest SMB loyalty point platform

SEOUL, South Korea, June 29, 2020 — On June 29th, South Korea’s Blockchain Project Carry Protocol announced that it started data collection from the offline market targeting roughly half of the South Korean population (23M users) with South Korea’s largest SMB loyalty platform, Dodo Point. The data collection feature…

Palma Ceia SemiDesign Announces Sampling for PCS11ax28, New 802.11ax Transceiver

SANTA CLARA, California, June 29, 2020 — Palma Ceia SemiDesign, a fabless semiconductor company specializing in semiconductor chips and IP for next-generation wireless connectivity, today announced the PCS11ax28, its new chip for the 802.11ax Wi-Fi standard, is now available for customer sampling. "We are…