BEIJING, March 3, 2023 — As China’s important annual political gatherings, the National People’s Congress (NPC) and Chinese People’s Political Consultative Conference (CPPCC), known as the "Two Sessions," will…

SurplusGLOBAL Announces Executive Promotion, Recruitment, and Establishment of Equipment Technology Team

SEOUL, South Korea, March 3, 2023 — SurplusGLOBAL, the leading global platform company for pre-owned semiconductor equipment (www.SurplusGLOBAL.com), announced on the 27th a major organizational restructuring to achieve sustainable business…

US proteomics sector set for shake-up as new IonOpticks tech unveiled

IonOpticks to introduce the TS, a fully integrated column heating and interface solution for Thermo Scientific users MELBOURNE, Australia, March 3, 2023 — IonOpticks, a producer of high-performance…

GLN International Attracts Investment to Lead the Global QR Payment/Withdrawal Market

SEOUL, South Korea, March 3, 2023 — GLN International, a global QR payment/withdrawal platform, announced the successful completion of a strategic investment from four domestic and international institutions. The…

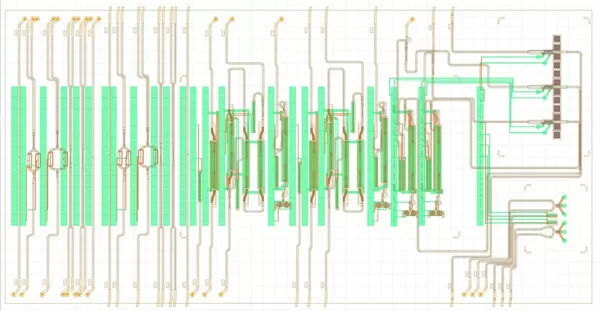

OpenLight Announces Availability of First Process Design Kit Sampler to Accelerate Component Testing

New Product Offers Lab-Testing Flexibility and Enhances PIC Design Accuracy to Accelerate Time to Market MOUNTAIN VIEW, Calif., March 3, 2023 — To enhance familiarity with process technologies and…

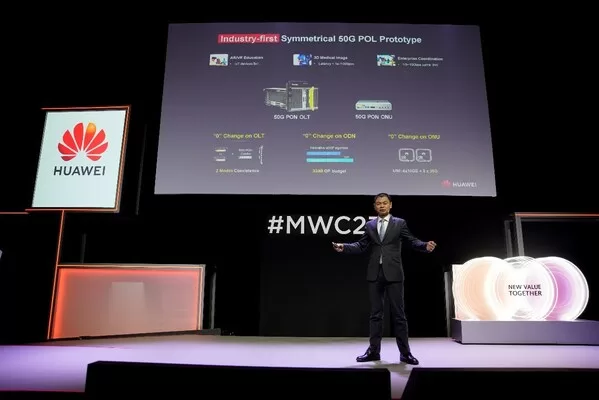

Huawei Launches Industry-First 50G POL Prototype for Next-Generation Wi-Fi 7 Campus Networks

BARCELONA, Spain, March 2, 2023 — During the Mobile World Congress 2023 (MWC 2023), Huawei launched the industry’s first 50G POL prototype to help industry customers build next-generation Wi-Fi…

TI’s GaN technology and real-time MCUs power LITEON Technology’s new server power supply design

Adoption of GaN & digital controller in new design helps engineers improve power density, conversion efficiency, dynamic response and reliability TAIPEI,…

Notice Regarding The Launch of “MtechA”, an M&A intermediary Digital Transformation service

TOKYO, March 2, 2023 — GA technologies Co., Ltd. (Headquarters: Minato-Ku, Tokyo; CEO: Ryo Higuchi; Securities Code: 3491 the "Company") hereby announces the launch…

ZTE holds Global Industrial Innovation Forum at MWC 2023, shaping digital innovation

ZTE held a Global Industrial Innovation Forum with the theme of "Shaping Digital Innovation" at MWC 2023 The Forum gathered experts to deliver keynote speeches and discuss around…

Mabl Strengthens Commitment to Japanese Quality Engineering Community with New Certification Program

New Japanese learning resources allow more quality professionals to build in-demand quality engineering skills. BOSTON, March 1, 2023 — mabl, the SaaS leader…