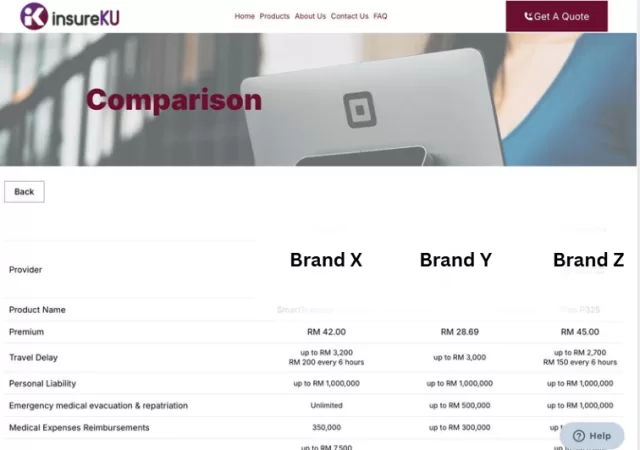

InsureKU launches with its initially offering allowing users to compare and contrast insurance and takaful offerings seamlessly.

Taobao Goes Fully Local with Malay Language Interface Coming in June 2025

Taobao is preparing to go fully local in Malaysia with the looming launch of its Malay Interface.

Synology Pushes “Certified” Hard Disk for Its More Premium Solutions

Synology looks to push “certified” hard disks for its more premium offerings seemingly promising firmware level optimizations.

U Mobile Partners with Huawei & ZTE to Deploy Malaysia’s Second 5G Network

U Mobile announces roll out plan of Malaysia’s second 5G network with ambitious goal of 80% COPA in the first 12 months with Huawei and ZTE spearheading.

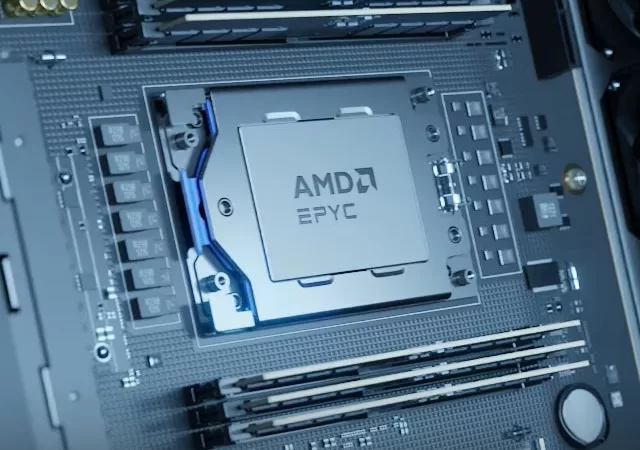

Google Cloud C4D & H4D Virtual Machines Available with AMD EPYC Processors

Google’s newest virtual machines are available with AMD’s latest EPYC processors for high performance computing.

Kyndryl and LifeTech Group Partner to Establish Malaysian Security Operations Centre

Kyndryl and LifeTech partner to empower cyber resilience through the establishment of the first Malaysian Security Operations Centre in the public cloud.

Infobip’s Trend Report Highlights Growing Role of Video and Voice

Infobip’s Messaging Trends Report for 2025 highlights the surge in Video and Voice among other insights

[MWC 2025] AWS Brings Edge Compute to Telcos with Specially Designed AWS Outpost Racks

AWS empowers telco digitization with specialised AWS Outpost offerings enabling edge computing and OpenRAN at scale.

How IT Leaders Can Give Employees The ‘Magic Touch’ with Tech

Uncover the role of Lenovo in addressing the digital skills gap, making workplace technology accessible for everyone.

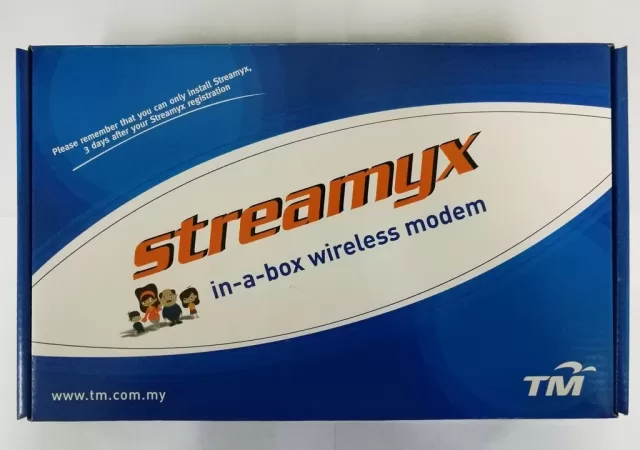

TM’s Copper Based Streamyx Broadband Ending in February 2025

TM announces the sunsetting of its copper based services including Streamyx and Unifi Lite.