Raiz, the micro-investing platform designed to make investing accessible, has announced its departure from the Malaysian market after four years of operation. This news comes as a surprise to some, as Raiz had positioned itself as a champion of financial inclusion, offering Malaysians a user-friendly platform to start their investment journey.

A Review of Raiz’s Malaysian Chapter

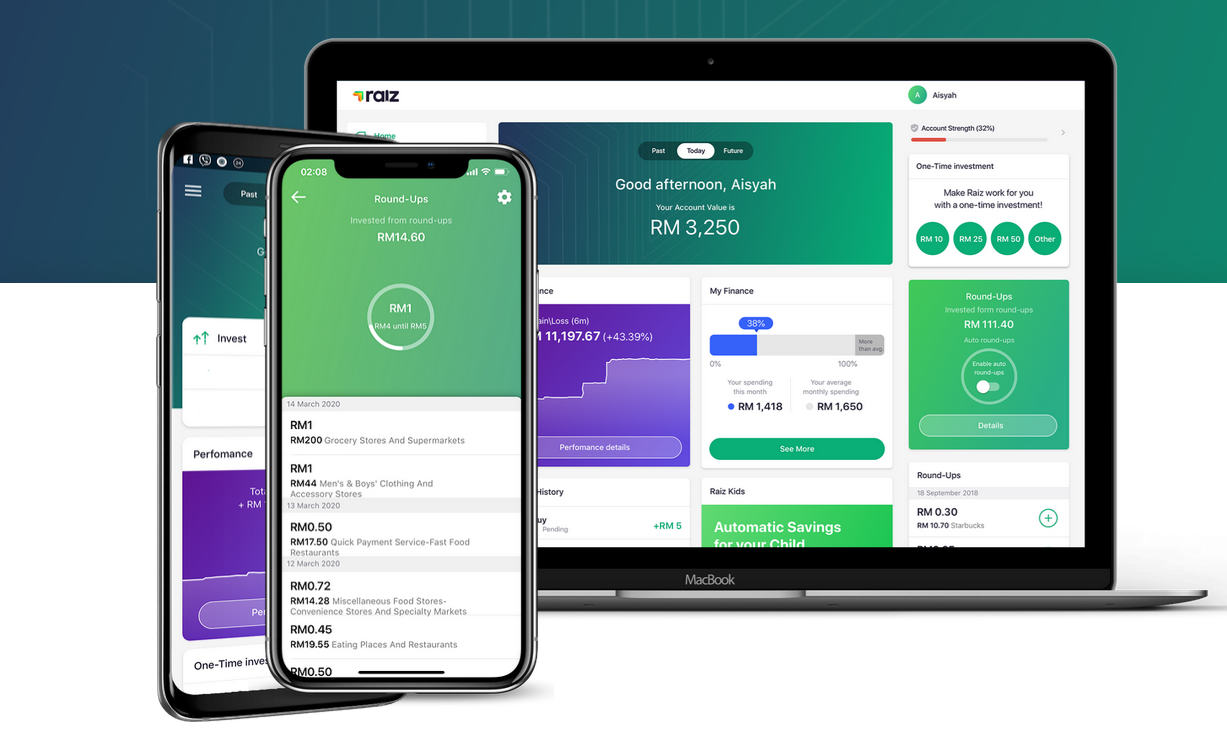

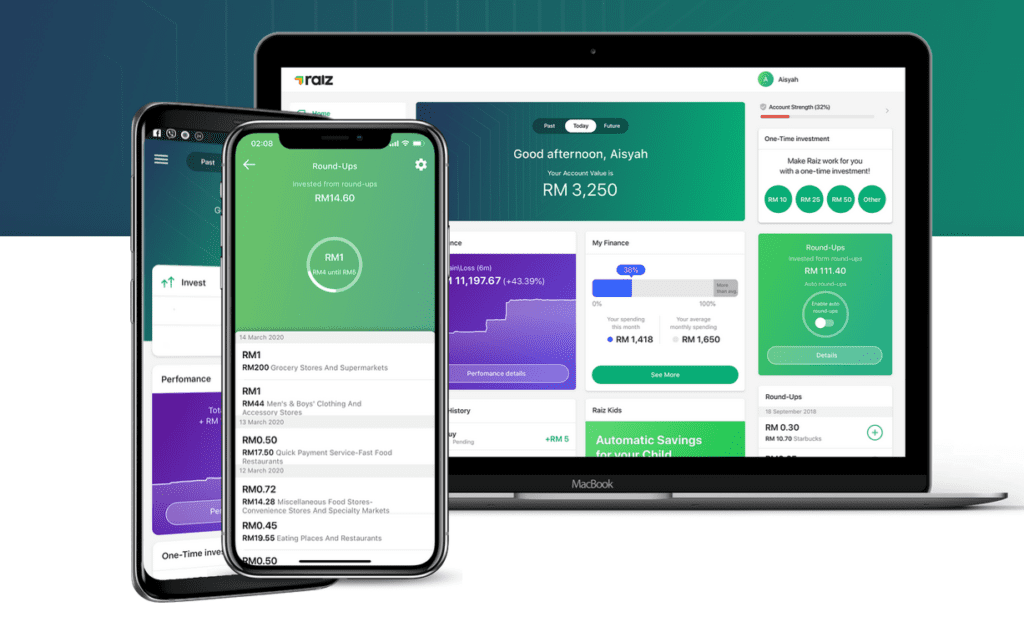

Launched in 2020 by a joint venture between Jewel Digital (a subsidiary of Permodalan Nasional Berhad or PNB) and Raiz Invest Australia, Raiz quickly gained traction among Malaysians seeking a convenient way to invest. Their app-based platform allowed users to start investing with as little as RM1, removing the traditional high barriers to entry associated with investing.

Despite its user-friendly approach, Raiz faced challenges in the competitive Malaysian financial landscape. Established players with robust investment products and extensive branch networks may have posed difficulties for the relatively new platform. Additionally, the relatively young Malaysian micro-investing market itself might not have reached the critical mass necessary for Raiz’s long-term sustainability.

Raiz is committed to ensuring a smooth transition for its Malaysian user base. A dedicated shutdown plan is in place, with RM3 million allocated to facilitate a structured and timely wind-down process. Existing users will be notified of the closure and provided with a timeframe to withdraw their invested funds.

Raiz is attributing its Malaysian exit to a strategic decision to focus on strengthening and expanding its core business in Australia. With a more established micro-investing market and a larger user base, Raiz believes it can achieve greater growth and profitability down under.

What This Means for Malaysian Raiz Users

Raiz’s departure doesn’t necessarily signify the end of micro-investing opportunities in Malaysia. Several local players are vying for a slice of this growing market, offering similar app-based investment platforms with low minimum investment requirements. As Malaysians become more financially savvy, the demand for accessible investment options is likely to remain strong.

For Raiz users in Malaysia, the news might be inconvenient, but not necessarily detrimental. Investors have ample time to withdraw their funds and explore alternative platforms that suit their needs. This could be an opportunity to compare features, fees, and investment options offered by various micro-investing players in the market.