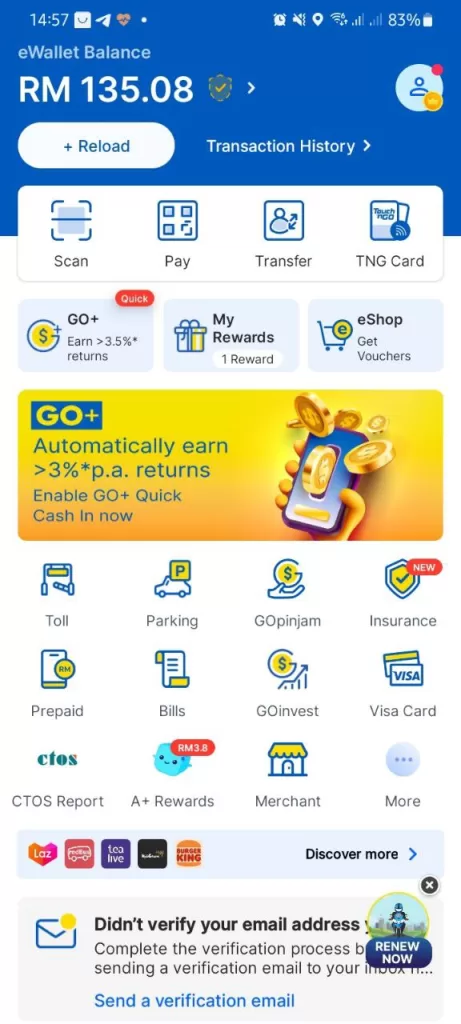

Touch ‘n Go should not be an unfamiliar name to Malaysians or residents of Malaysia. They are technically the first company in Malaysia to introduce cashless transactions via their Touch ‘n Go prepaid cards for tolls and later for public transportations. They were not the first to introduce an eWallet app for Malaysia, probably one of the latest. At their current state though, they are one of the most widely used eWallet apps in Malaysia.

As one of the most widely adopted eWallet in Malaysia, security and safety in transactions and storing money is a bigger concern than ever before. Even with various digital banking systems in place, scams and fraud activities still can happen. In that regards, Touch ‘n Go has introduced five measures in accordance to Bank Negara of Malaysia’s latest mandatory guidelines for banks to combat fraud and scams on their own platform.

Venturing Beyond Passwords

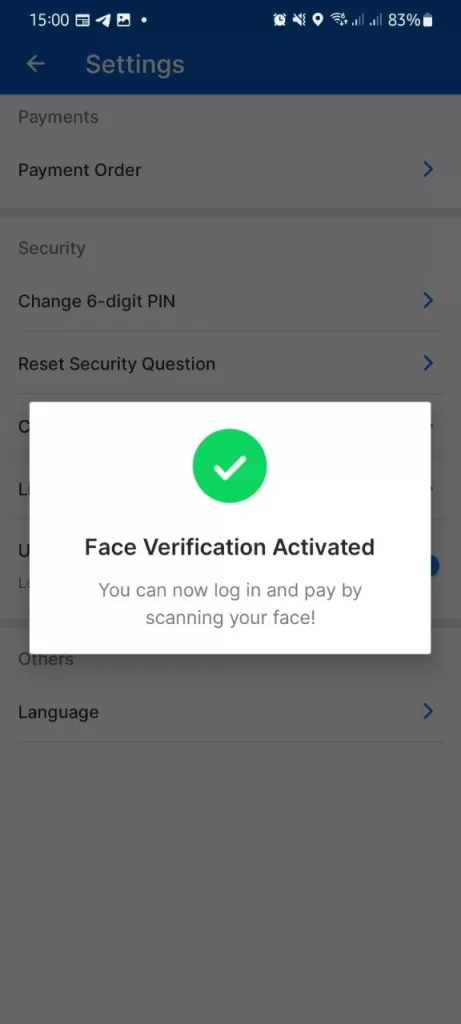

The first of the five measures implemented by Touch ‘n Go is to move beyond one-time password (OTP) systems to more secure systems. For Touch ‘n Go, that more secure system is through face verification. Facial recognition, as a security measure, is nothing new. It has been a security system that has been introduced on Android smartphones for a long time now and has been made better with each iteration and new technologies. In leveraging a modern smartphone’s camera system, the Touch ‘n Go eWallet app now requires a particular user’s face for app logins, PIN changes, and even perform transactions. They also require users to blink when using the feature just to make sure that offenders are not just using a photo of the user to access the app.

Tighter Fraud Detection and Blocking

Fraud detection has been a large part of operating digital payment systems. Even banks have their own ways and guidelines in handling fraudulent transactions. To ensure they can prevent fraudulent transactions, they have placed a few guidelines and rules to transactions. In some cases, transaction limits are set to prevent certain transactions from happening.

In accordance with the latest guidelines from Bank Negara Malaysia, Touch ‘n Go have implemented new rule sets for transactions. According to Touch ‘n Go, the new rule sets are tighter than before. There is also a new set of thresholds for transactions that will trigger alerts from the app. If any abnormal activities are tracked, an email alert will be sent out to users. Users still can set transaction limits too, in case of transactions where the set limit is breached, users will need to verify the transactions further.

One Device, One Account

While it is not a unique feature at this point, you can only attach your Touch ‘n go eWallet account to a single device. That means that even if you have two smartphones, you can only use your Touch ‘n Go eWallet on one of your devices. You cannot have both devices logged into the eWallet too.

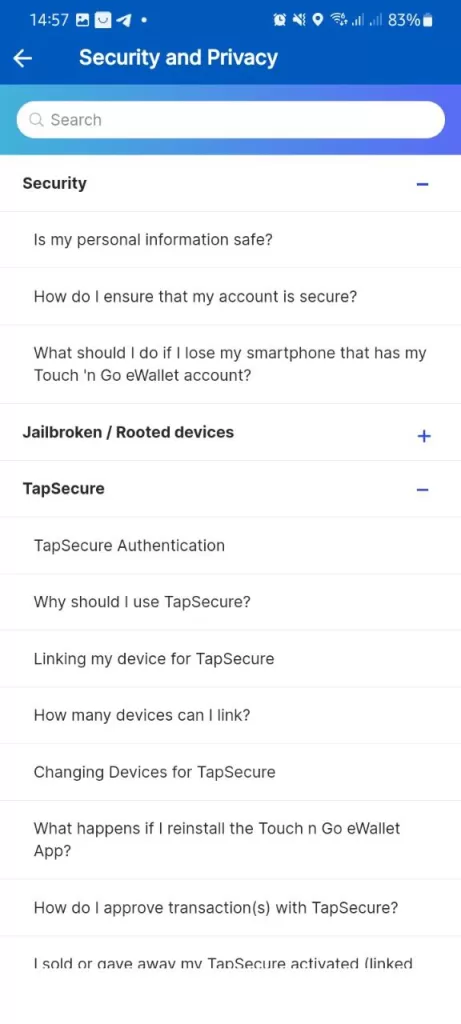

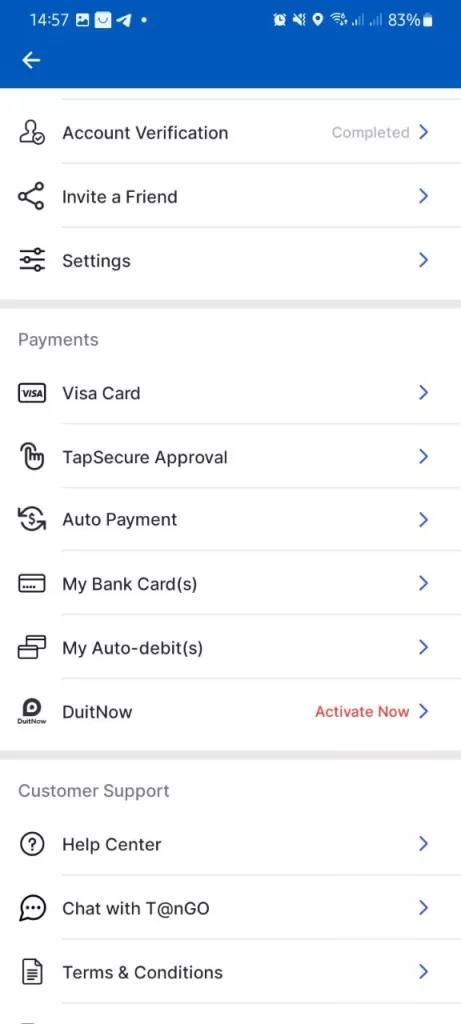

They also introduced a feature called TapSecure on the app. The feature requires users to authenticate and verify transactions via the app. The feature can only be attached to one users’s linked device for transaction approvals within the user’s account.

Still Getting Through Toll Gates

All the new measures point to ensuring that users verify themselves before making any sort of transactions. There is a problem, however. Touch ‘n Go eWallet has been adopted to work with toll gate payments in Malaysia. If the measures are also implemented for toll payments, toll gates could be backed up.

In that sense, Touch ‘n Go is only implementing the security and verification measures based on their risk assessment. For low-risk transactions like toll gate payments, verification will not be required. There are also other low risk transactions implemented within Touch ‘n Go that will not trigger the security measures.

If you are logging into your eWallet for the first time on a new device, there will be a number of limitations to the app usage and transaction limit too within the first 48 hours. That limit also includes topping up the eWallet. Any transactions and top ups that is not within the limit will be rejected outrightly.

Easier to Reach

To bolster the effort in fraud prevention, Touch ‘n Go has also set up their own dedicated channel for fraud and scam reports. The call center will be based out of the National Scam Response Centre, Malaysia’s own fraud and scam response unit and center. The dedicated channel links you directly to a specialized team that will attend to any fraud or scam cases or queries. You can reach them at +603-5022 3888 and select “4” to make any fraud or scam reports.

For more information on Touch ‘n Go’s latest safety measures, you can check out their website.