SHANGHAI, Nov. 24, 2022 /PRNewswire/ — Lufax Holding Ltd (“Lufax” or the “Company”) (NYSE: LU), a leading technology-empowered personal financial services platform in China, today announced its unaudited financial results for the third quarter ended September 30, 2022.

Third Quarter 2022 Financial Highlights

- Total income decreased by 17.2% to RMB13,193 million (US$1,855 million) in the third quarter of 2022 from RMB15,924 million in the same period of 2021.

- Net profit decreased by 67.1% to RMB1,355 million (US$190 million) in the third quarter of 2022 from RMB4,115 million in the same period of 2021.

|

(In millions except percentages, unaudited)

|

Three Months Ended September 30,

|

|

|

2021

|

2022

|

YoY

|

|

RMB

|

RMB

|

USD

|

|

|

Total income

|

15,924

|

13,193

|

1,855

|

(17.2 %)

|

|

Total expenses

|

(9,936)

|

(11,082)

|

(1,558)

|

11.5 %

|

|

Total expenses excluding credit and asset impairment losses, financial costs and other (gains)/losses

|

(7,730)

|

(6,746)

|

(948)

|

(12.7 %)

|

|

Credit and asset impairment losses, financial costs and other (gains)/losses

|

(2,205)

|

(4,336)

|

(610)

|

96.6 %

|

|

Net profit

|

4,115

|

1,355

|

190

|

(67.1 %)

|

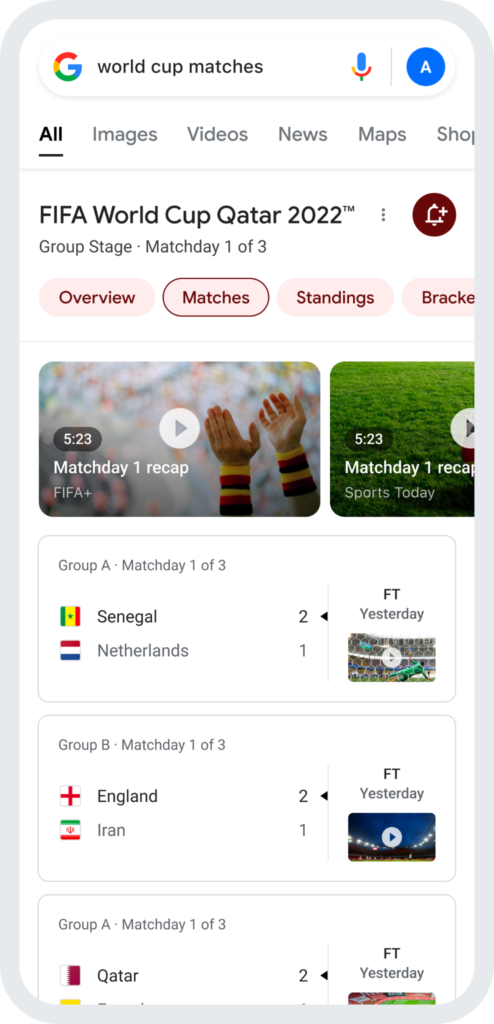

Third Quarter 2022 Operational Highlights

Retail credit facilitation business:

- Outstanding balance of loans facilitated decreased by 1.3% to RMB636.5 billion as of September 30, 2022 from RMB645.1 billion as of September 30, 2021.

- Cumulative number of borrowers increased by 15.3% to approximately 18.7 million as of September 30, 2022 from approximately 16.2 million as of September 30, 2021.

- During the third quarter of 2022, excluding the consumer finance subsidiary, 87.3% of new loans facilitated were disbursed to small business owners, up from 80.5% in the same period of 2021.

- New loans facilitated decreased by 27.9% to RMB123.8 billion in the third quarter of 2022 from RMB171.7 billion in the same period of 2021.

- During the third quarter of 2022, excluding the consumer finance subsidiary, the Company bore risk on 21.7% of its new loans facilitated, up from 19.6% in the same period of 2021.

- As of September 30, 2022, including the consumer finance subsidiary, the Company bore risk on 22.5% of its outstanding balance, up from 14.8% as of September 30, 2021. Credit enhancement partners bore risk on 73.1% of outstanding balance, among which Ping An P&C accounted for a majority.

- For the third quarter of 2022, the Company’s retail credit facilitation revenue take rate[1] based on loan balance was 7.8%, as compared to 9.7% for the third quarter of 2021.

- C-M3 flow rate[2] for the total loans the Company had facilitated was 0.8% in the third quarter of 2022, as compared to 0.7% in the second quarter of 2022. Flow rates for the general unsecured loans and secured loans the Company had facilitated were 0.9% and 0.4%, respectively, in the third quarter of 2022, as compared to 0.8% and 0.3%, respectively, in the second quarter of 2022.

- Days past due (“DPD”) 30+ delinquency rate[3] for the total loans the Company had facilitated was 3.6% as of September 30, 2022, as compared to 3.1% as of June 30, 2022. DPD 30+ delinquency rate for general unsecured loans was 4.2% as of September 30, 2022, as compared to 3.6% as of June 30, 2022. DPD 30+ delinquency rate for secured loans was 1.6% as of September 30, 2022, as compared to 1.4% as of June 30, 2022.

- DPD 90+ delinquency rate[4] for the total loans facilitated was 2.1% as of September 30, 2022, as compared to 1.7% as of June 30, 2022. DPD 90+ delinquency rate for general unsecured loans was 2.4% as of September 30, 2022, as compared to 2.0% as of June 30, 2022. DPD 90+ delinquency rate for secured loans was 0.9% as of September 30, 2022, as compared to 0.7% as of June 30, 2022.

Wealth management business:

- Total number of registered users grew to 52.6 million as of September 30, 2022 from 48.7 million as of September 30, 2021.

- Total number of active investors grew to 15.5 million as of September 30, 2022 from 15.3 million as of September 30, 2021.

- Total client assets decreased by 2.0% to RMB416.8 billion as of September 30, 2022 from RMB425.1 billion as of September 30, 2021.

- The 12-month investor retention rate was 95.1% as of September 30, 2022, as compared to 95.9% as of September 30, 2021.

- Contribution to total client assets from customers with investments of more than RMB300,000 on the Company’s platform increased to 81.8% as of September 30, 2022 from 80.8% as of September 30, 2021.

- During the third quarter of 2022, the annualized take rate[5] for current products and services on the Company’s wealth management platform was 34.7 bps, down from 43.1 bps during the second quarter of 2022.

Mr. YongSuk Cho, Chairman and Chief Executive Officer of Lufax, commented, “The third quarter was a challenging time for our company and for our industry as a whole. As our core client base of small business owners continued to feel an outsized impact from a deteriorating macro environment, we faced rising credit impairment losses and credit enhancement costs, weighing on our profitability. In contrast, the regulatory environment is becoming increasingly stabilized; oversight has been normalized and there is an absence of significant outstanding issues for our company. While credit quality deterioration advanced across the board in the third quarter, we witnessed growing differences in economic resilience and significant divergence in credit performance by region. Taking Shanghai for example, the C-M3 ratio for general unsecured loans spiked to 2.3% in Q2 2022, but within a short period of time after re-opening, quickly returned to the pre-lockdown level of 0.5% in Q3 2022, demonstrating strong resilience. On average, the C-M3 ratio for top performing regions, which mainly consist of cities and regions with strong economic foundations improved by 1 basis point in the third quarter compared to the second quarter, while the average C-M3 ratio for average performing regions and less desirable performing regions deteriorated by 13 and 20 basis points, respectively, during the same period. Today, about two-thirds of our existing business is in cities and regions where we believe the economic foundations are stronger and will underpin and catalyze our recovery from current downturn. This is clearly a challenge for us but we are confident in our ability to execute. We will adjust our business strategies by deepening our focus on well-rated small business owners, in more resilient cities, with increased reliance on our direct sales force channel. In the nearer-term, we expect this adjusted strategy will generate new loan facilitation volumes at approximately two-thirds of the volumes we have generated in recent years. We will also use this business re-prioritization to continue to upgrade our technology, operations, and risk management with the objective of strengthening our long-term market leadership in the small business owner segment. Fortified by our competitive advantages, our fine-tuned strategy, our pro-regulation business model, our strong balance sheet and long-term partnerships with financial institutions, we will navigate through this difficult period.”

Mr. Gregory Gibb, Co-Chief Executive Officer of Lufax, commented, “The deterioration in credit quality during the third quarter negatively impacted our results, with new loan volumes declining and credit impairment losses rising. Overall profitability has also been negatively impacted by higher insurance premium. In light of the challenges, we have already tightened customer selection and new business initiated in the last several quarters has delivered better and more resilient performance. We will continue to take the path of strengthening collection on existing vintages and building up a more sustainable and profitable new portfolio, while at the same time we will refine our channel management and optimize our direct sales force to be more nimble, productive and effective in customer targeting and selection. Though this will result in reduced new business volumes and gross revenues in the medium-term, new business should generate better results as compared to the historical loan vintages as a whole and drive a U-shaped recovery in our financial performance. Facing the uncertainties ahead, we will continue strengthening our operating capabilities and our partnerships with financial institutions. We have recently launched a new small business owner ecosystem, LuDianTong, an open-platform design which we populated with digital operating tools and industry-focused content for SBOs to operate their businesses more effectively. We are also continuing to develop LuJinTong, which helps banks with strong risk capabilities acquire borrowers directly through dispersed sourcing agents nation-wide. In addition, we have also gained 16 new bank partners under our risk-sharing model compared to a year ago. Looking ahead, our bottom-line recovery will be driven by the evolving credit performance and run-off speed of our historical vintages, and our prioritized new businesses’ growth rate. Finally, we would like to thank our shareholders for their continuous support to our business. In October, we distributed our first half 2022 dividends of USD0.17 per ADS, and we will continue to deliver value to our shareholders.”

Mr. David Choy, Chief Financial Officer of Lufax, commented, “Faced with worsening macroeconomic headwinds, we dedicated ourselves to building a more sustainable business model and improving operational resilience. As a result, we recorded RMB13.2 billion in total income for the third quarter and reduced our operating-related expenses by 12.7% year over year. Our balance sheet remains strong, with our cash at bank balance increasing to RMB45.8 billion. In addition, liquid assets[6] maturing in 90 days or less amounted to 46.5 billion as of the end of September 2022. Our guarantee company’s net capital stood at 47.8 billion and the leverage was stable at 2.1x, compared to a regulatory allowance of 10x. Against a challenging macro backdrop, this performance demonstrates the efficacy of our business model and gives us confidence as we strive to deliver long term growth and sustainable value for our shareholders.”

Third Quarter 2022 Financial Results

TOTAL INCOME

Total income decreased by 17.2% to RMB13,193 million (US$1,855 million) in the third quarter of 2022 from RMB15,924 million in the same period of 2021. The Company’s revenue mix changed with the evolution of its business model, as it gradually bore more credit risk and increased funding from consolidated trust plans that provided lower funding costs.

|

Three Months Ended September 30,

|

|

|

(In millions except percentages, unaudited)

|

2021

|

2022

|

YoY

|

|

RMB

|

% of total

income

|

RMB

|

% of total

income

|

|

|

Technology platform-based income

|

9,567

|

60.1 %

|

6,672

|

50.6 %

|

(30.3 %)

|

|

Retail credit facilitation service fees

|

9,100

|

57.1 %

|

6,308

|

47.8 %

|

(30.7 %)

|

|

Wealth management transaction and service fees

|

467

|

2.9 %

|

364

|

2.8 %

|

(22.1 %)

|

|

Net interest income

|

3,802

|

23.9 %

|

4,618

|

35.0 %

|

21.5 %

|

|

Guarantee income

|

1,293

|

8.1 %

|

1,863

|

14.1 %

|

44.1 %

|

|

Other income

|

997

|

6.3 %

|

(129)

|

(1.0 %)

|

(112.9 %)

|

|

Investment income

|

266

|

1.7 %

|

168

|

1.3 %

|

(36.8 %)

|

|

Share of net profits of investments accounted

for using the equity method

|

(2)

|

0.0 %

|

0

|

0.0 %

|

(100.0 %)

|

|

Total income

|

15,924

|

100.0 %

|

13,193

|

100.0 %

|

(17.2 %)

|

- Technology platform-based income decreased by 30.3% to RMB6,672 million (US$938 million) in the third quarter of 2022 from RMB9,567 million in the same period of 2021 due to a decrease in new loan sales, client assets, and service fees.

– Retail credit facilitation service fees decreased by 30.7% to RMB6,308 million (US$887 million) in the third quarter of 2022 from RMB9,100 million in the same period of 2021, mainly due to a decrease in new loan sales and a lower take rate, and changes in the Company’s business model that resulted in more income being recognized in net interest income and guarantee income.

– Wealth management transaction and service fees decreased by 22.1% to RMB364 million (US$51 million) in the third quarter of 2022 from RMB467 million in the same period of 2021. The decrease was mainly driven by the decrease in fees generated from the Company’s current products, partially offset by the increase in fees generated from platform services[7].

- Net interest income increased by 21.5% to RMB4,618 million (US$649 million) in the third quarter of 2022 from RMB3,802 million in the same period of 2021, mainly as a result of 1) the Company’s increased usage of trust funding channels that were consolidated by the Company (as of September 30, 2022, the Company’s on-balance sheet loans accounted for 36.9% of its total loan balance under management, as compared to 31.2% as of September 30, 2021), and 2) an increase in the volume of new consumer finance loans.

- Guarantee income increased by 44.1% to RMB1,863 million (US$262 million) in the third quarter of 2022 from RMB1,293 million in the same period of 2021, primarily due to the increase in the loans for which the Company bore credit risk.

- Other income was negative RMB129 million (negative US$18 million) in the third quarter of 2022 compared to other income of RMB997 million in the same period of 2021, majority of the decreases were due to 1) a refund of account management fees to the Company’s primary credit enhancement partner as a result of worse-than-expected collection performance, and 2) the narrowing down of service scope and change of fee structure that the Company provided and charged to its primary credit enhancement partner since this quarter.

- Investment income decreased to RMB168 million (US$24 million) in the third quarter of 2022 from RMB266 million in the same period of 2021, mainly due to a decrease in investment assets.

TOTAL EXPENSES

Total expenses increased by 11.5% to RMB11,082 million (US$1,558 million) in the third quarter of 2022 from RMB9,936 million in the same period of 2021. This increase was mainly driven by credit impairment losses, since credit impairment losses increased by 137.7% to RMB3,956 million (US$556 million) in the third quarter of 2022 from RMB1,664 million in the same period of 2021. Total expenses excluding credit impairment losses, asset impairment losses, finance costs, and other (gains)/losses decreased by 12.7% to RMB6,746 million (US$948 million) in the third quarter of 2022 from RMB7,730 million in the same period of 2021.

|

Three Months Ended September 30,

|

|

|

(In millions except percentages, unaudited)

|

2021

|

2022

|

YoY

|

|

RMB

|

% of total

income

|

RMB

|

% of total

income

|

|

|

Sales and marketing expenses

|

4,609

|

28.9 %

|

4,071

|

30.9 %

|

(11.7 %)

|

|

General and administrative expenses

|

937

|

5.9 %

|

592

|

4.5 %

|

(36.8 %)

|

|

Operation and servicing expenses

|

1,660

|

10.4 %

|

1,600

|

12.1 %

|

(3.6 %)

|

|

Technology and analytics expenses

|

524

|

3.3 %

|

484

|

3.7 %

|

(7.6 %)

|

|

Credit impairment losses

|

1,664

|

10.4 %

|

3,956

|

30.0 %

|

137.7 %

|

|

Asset impairment losses

|

410

|

2.6 %

|

68

|

0.5 %

|

(83.4 %)

|

|

Finance costs

|

168

|

1.1 %

|

306

|

2.3 %

|

82.1 %

|

|

Other (gains)/losses – net

|

(36)

|

(0.2 %)

|

7

|

0.1 %

|

(119.4 %)

|

|

Total expenses

|

9,936

|

62.4 %

|

11,082

|

84.0 %

|

11.5 %

|

|

|

|

|

|

|

|

|

- Sales and marketing expenses decreased by 11.7% to RMB4,071 million (US$572 million) in the third quarter of 2022 from RMB4,609 million in the same period of 2021.

– Borrower acquisition expenses decreased by 20.5% to RMB2,030 million (US$285 million) in the third quarter of 2022 from RMB2,553 million in the same period of 2021. The decrease was mainly due to decreased new loan sales and reductions in commissions.

– Investor acquisition and retention expenses decreased by 62.8% to RMB81 million (US$11 million) in the third quarter of 2022 from RMB218 million in the same period of 2021, mostly due to the decrease in sales of current products.

– General sales and marketing expenses increased by 6.6% to RMB1,960 million (US$276 million) in the third quarter of 2022 from RMB1,839 million in the same period of 2021. This increase was primarily due to the increase in sales costs related to platform services and the increase in staff costs for sales and marketing personnel.

- General and administrative expenses decreased by 36.8% to RMB592 million (US$83 million) in the third quarter of 2022 from RMB937 million in the same period of 2021 as a result of the Company’s expense control measures.

- Operation and servicing expenses decreased by 3.6% to RMB1,600 million (US$225 million) in the third quarter of 2022 from RMB1,660 million in the same period of 2021, primarily due to the decrease of trust plan management expenses and the Company’s expense control measures.

- Technology and analytics expenses decreased by 7.6% to RMB484 million (US$68 million) in the third quarter of 2022 from RMB524 million in the same period of 2021, as a result of the Company’s improved efficiency.

- Credit impairment losses increased by 137.7% to RMB3,956 million (US$556 million) in the third quarter of 2022 from RMB1,664 million in the same period of 2021, mainly driven by 1) the increase of provision and indemnity loss driven by increased risk exposure, and 2) the change in credit performance due to the impact of the COVID-19 outbreak.

- Asset impairment losses decreased by 83.4% to RMB68 million (US$10 million) in the third quarter of 2022 from RMB410 million in the same period of 2021, mainly due to the higher base of impairment loss in the third quarter of 2021 driven by impairment loss of intangible assets and goodwill.

- Finance costs increased by 82.1% to RMB306 million (US$43 million) in the third quarter of 2022 from RMB168 million in the same period of 2021, mainly due to an increase in interest expense.

- Other losses were RMB7 million (US$1 million) in the third quarter of 2022 compared to other gains of RMB36 million in the same period of 2021, mainly due to the foreign exchange loss in the third quarter of 2022.

|

[1] The take rate of retail credit facilitation business is calculated by dividing the aggregated amount of retail credit facilitation service fee, net interest income, guarantee income and the penalty fees and account management fees by the average outstanding balance of loans facilitated for each period.

|

|

[2] Flow rate estimates the percentage of current loans that will become non-performing at the end of three months, and is defined as the product of (i) the loan balance that is overdue from 1 to 29 days as a percentage of the total current loan balance of the previous month, (ii) the loan balance that is overdue from 30 to 59 days as a percentage of the loan balance that was overdue from 1 to 29 days in the previous month, and (iii) the loan balance that is overdue from 60 to 89 days as a percentage of the loan balance that was overdue from 30 days to 59 days in the previous month. Loans from legacy products and consumer finance subsidiary are excluded from the flow rate calculation.

|

|

[3] DPD 30+ delinquency rate refers to the outstanding balance of loans for which any payment is 30 to 179 calendar days past due divided by the outstanding balance of loans. Loans from legacy products and consumer finance subsidiary are excluded from the calculation.

|

|

[4] DPD 90+ delinquency rate refers to the outstanding balance of loans for which any payment is 90 to 179 calendar days past due divided by the outstanding balance of loans. Loans from legacy products and consumer finance subsidiary are excluded from the calculation.

|

|

[5] The take rate for the wealth management business is calculated by dividing total wealth management transaction and service fees for current products by average client assets in the Company’s current products. Part of the wealth management transaction and service fees do not generate client assets.

|

|

[6] The liquid assets consist of Cash at bank, Financial assets at amortized cost, Financial assets purchased under reverse repurchase agreements and Financial assets at fair value through profit or loss with a maturity of 90 days or less as of September 30, 2022.

|

|

[7] Platform services are provided by the Company’s platform, and this income is primarily based on transaction volume.

|

NET PROFIT

Net profit decreased by 67.1% to RMB1,355 million (US$190 million) in the third quarter of 2022 from RMB4,115 million in the same period of 2021, driven by the aforementioned factors.

EARNINGS PER ADS

Basic and diluted earnings per American Depositary Share (“ADS”) were both RMB0.58 (US$0.08) in the third quarter of 2022.

BALANCE SHEET

The Company had RMB45,803 million (US$6,439 million) in cash at bank as of September 30, 2022, as compared to RMB34,743 million as of December 31, 2021. Net assets of the Company amounted to RMB95,097 million (US$13,369 million) as of September 30, 2022, as compared to RMB94,559 million as of December 31, 2021.

Recent Developments

Changes in Board Composition

Mr. Rui Li, Mr. Hanjie Ou and Mr. Yunwei Tang have tendered their resignations as directors of the Company and will no longer serve as members of the Company’s board of directors (the “Board”) or any committee of the Board, effective as of November 23, 2022. Ms. Fangfang Cai, Mr. Guangheng Ji and Ms. Xin Fu have each been appointed as a director of the Company, and Mr. David Xianglin Li, currently an independent director of the Company, has been appointed as a member of the audit committee of the Board, effective as of November 23, 2022.

Ms. Fangfang Cai has been serving as an executive director of Ping An Insurance (Group) Company of China, Ltd. (together with its subsidiaries, “Ping An Group”) since July 2014, chief human resources officer of Ping An Group since March 2015, and deputy general manager of Ping An Group since December 2019. Ms. Cai also serves as a director of a number of controlled subsidiaries of Ping An Group, including Ping An Bank, Ping An Life, Ping An Property & Casualty, and Ping An Asset Management. Ms. Cai has over 26 years of experience in the finance industry. Ms. Cai served as vice chief human resources officer of Ping An Group from September 2013 to March 2015, vice chief financial officer and the general manager of the planning department of Ping An Group from February 2012 to September 2013, deputy general manager and then general manager of compensation planning and management department at human resources center of Ping An Group from October 2009 to February 2012. Prior to joining Ping An Group, Ms. Cai served as consulting director of Watson Wyatt Consultancy (Shanghai) Ltd. from June 2006 to July 2007 and audit director on the financial industry of British Standards Institution Management Systems Certification Co., Ltd from July 2003 to June 2006. Ms. Cai obtained a master’s degree in accounting from The University of New South Wales in May 2000.

Mr. Guangheng Ji has been serving as senior vice president of Ping An Group since March 2022. Mr. Ji served as the chairman of the board of directors of the Company from January 2021 to August 2022 and the co-chairman of the board of directors of the Company from April 2020 to January 2021. Mr. Ji has over 25 years of experience in the finance industry. Mr. Ji served as a number of positions at Industrial and Commercial Bank of China from July 1994 to April 2009, vice president of Shanghai Pudong Development Bank Co., Ltd., a company listed on the Shanghai Stock Exchange (SSE: 600000), from April 2009 to November 2015, chairman of the board of Shanghai Rural Commercial Bank Co., Ltd. from November 2015 to March 2019, and vice chairman of the board and co-president of Baoneng Group from March 2019 to March 2020. Mr. Ji obtained his bachelor’s and master’s degrees in geography and Ph.D. degree in economics from Peking University in July 1991, July 1994 and July 2009, respectively.

Ms. Xin Fu has been serving as the chief operating officer of Ping An Group since March 2022 and director of the strategic development center of Ping An Group since March 2020. She joined Ping An Group in October 2017 as general manager of its planning department, and served as deputy chief financial officer of Ping An Group between March 2020 and March 2022. Prior to joining Ping An Group, Ms. Fu served as a partner of Roland Berger management consulting financial services practices and an executive director of PricewaterhouseCoopers, where she had over ten years of experience in planning and implementing finance and fintech related projects. Ms. Fu has also been serving as a non-executive director of OneConnect Financial Technology Co., Ltd. (NYSE: OCFT; HKG: 6638) since November 2022. Ms. Fu obtained a master’s degree in business administration from Shanghai Jiao Tong University in June 2012.

Business Outlook

For the full year of 2022, the Company expects its new loans facilitated to decrease by 23% to 24% year over year to the range of RMB490 billion to RMB495 billion, client assets to decrease by 1% to 10% year over year to the range of RMB390 billion to RMB430 billion, total income to decrease by 6% to 8% year over year to the range of RMB57.0 billion to RMB58.0 billion, and net profit to decrease by 47% to 49% year over year to the range of RMB8.5 billion to RMB8.9 billion.

These forecasts reflect the Company’s current and preliminary views on the market and operational conditions, which are subject to change.

Conference Call Information

The Company’s management will hold an earnings conference call at 8:00 P.M. U.S. Eastern Time on Wednesday, November 23, 2022 (9:00 A.M. Beijing Time on Thursday, November 24, 2022) to discuss the financial results. For participants who wish to join the call, please complete online registration using the link provided below in advance of the conference call. Upon registering, each participant will receive a participant dial-in number, the Direct Event passcode, and a unique access PIN, which can be used to join the conference call.

Registration Link: https://www.netroadshow.com/events/login?show=bb2672a0&confId=44087

A replay of the conference call will be accessible through November 30, 2022 (dial-in numbers: +1 (866) 813-9403 or +1 (226) 828-7578; replay access code: 399471). A live and archived webcast of the conference call will also be available at the Company’s investor relations website at https://ir.lufaxholding.com.

About Lufax

Lufax Holding Ltd is a leading technology-empowered personal financial services platform in China. Lufax Holding Ltd primarily utilizes its customer-centric product offerings and offline to-online channels to provide retail credit facilitation services to small business owners and salaried workers in China as well as tailor-made wealth management solutions to China’s rapidly growing middle class. The Company has implemented a unique, capital-light, hub-and-spoke business model combining purpose-built technology applications, extensive data, and financial services expertise to effectively facilitate the right products to the right customers.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.1135 to US$1.00, the rate in effect as of September 30, 2022, as certified for customs purposes by the Federal Reserve Bank of New York.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Statements that are not historical facts, including statements about Lufax’s beliefs and expectations, are forward-looking statements. Lufax has based these forward-looking statements largely on its current expectations and projections about future events and financial trends, which involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control. These forward-looking statements include, but are not limited to, statements about Lufax’s goals and strategies; Lufax’s future business development, financial condition and results of operations; expected changes in Lufax’s income, expenses or expenditures; expected growth of the retail credit facility and wealth management markets; Lufax’s expectations regarding demand for, and market acceptance of, its services; Lufax’s expectations regarding its relationship with borrowers, platform investors, funding sources, product providers and other business partners; general economic and business conditions; and government policies and regulations relating to the industry Lufax operates in. Forward-looking statements involve inherent risks and uncertainties. Further information regarding these and other risks is included in Lufax’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and Lufax does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Investor Relations Contact

Lufax Holding Ltd

Email: Investor_Relations@lu.com

ICR, LLC

Robin Yang

Tel: +1 (646) 308-0546

Email: lufax.ir@icrinc

|

LUFAX HOLDING LTD

|

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED INCOME STATEMENTS

|

|

(All amounts in thousands, except share data, or otherwise noted)

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

2021

|

|

2022

|

|

2021

|

|

2022

|

|

RMB

|

|

RMB

|

|

USD

|

|

RMB

|

|

RMB

|

|

USD

|

|

Technology platform-based income

|

9,566,839

|

|

6,672,443

|

|

937,997

|

|

29,458,153

|

|

23,344,095

|

|

3,281,661

|

|

Retail credit facilitation service fees

|

9,100,213

|

|

6,308,263

|

|

886,802

|

|

27,959,069

|

|

21,920,355

|

|

3,081,515

|

|

Wealth management transaction and service fees

|

466,626

|

|

364,180

|

|

51,196

|

|

1,499,084

|

|

1,423,740

|

|

200,146

|

|

Net interest income

|

3,802,306

|

|

4,618,100

|

|

649,202

|

|

9,940,117

|

|

14,611,906

|

|

2,054,109

|

|

Guarantee income

|

1,293,440

|

|

1,863,293

|

|

261,938

|

|

2,735,404

|

|

5,701,766

|

|

801,542

|

|

Other income

|

996,942

|

|

(128,500)

|

|

(18,064)

|

|

3,106,310

|

|

1,107,077

|

|

155,630

|

|

Investment income

|

266,425

|

|

167,809

|

|

23,590

|

|

792,887

|

|

1,031,031

|

|

144,940

|

|

Share of net profits of investments accounted for

using the equity method

|

(1,572)

|

|

138

|

|

19

|

|

(29,418)

|

|

1,515

|

|

213

|

|

Total income

|

15,924,380

|

|

13,193,283

|

|

1,854,682

|

|

46,003,453

|

|

45,797,390

|

|

6,438,095

|

|

Sales and marketing expenses

|

(4,609,097)

|

|

(4,070,803)

|

|

(572,264)

|

|

(13,158,261)

|

|

(12,050,538)

|

|

(1,694,038)

|

|

General and administrative expenses

|

(937,181)

|

|

(592,216)

|

|

(83,252)

|

|

(2,588,459)

|

|

(2,079,697)

|

|

(292,359)

|

|

Operation and servicing expenses

|

(1,660,244)

|

|

(1,599,564)

|

|

(224,863)

|

|

(4,657,930)

|

|

(4,770,562)

|

|

(670,635)

|

|

Technology and analytics expenses

|

(523,926)

|

|

(483,617)

|

|

(67,986)

|

|

(1,487,347)

|

|

(1,414,885)

|

|

(198,901)

|

|

Credit impairment losses

|

(1,663,958)

|

|

(3,955,506)

|

|

(556,056)

|

|

(4,110,742)

|

|

(10,291,935)

|

|

(1,446,817)

|

|

Asset impairment losses

|

(409,547)

|

|

(68,051)

|

|

(9,566)

|

|

(411,596)

|

|

(420,007)

|

|

(59,044)

|

|

Finance costs

|

(168,090)

|

|

(305,879)

|

|

(43,000)

|

|

(728,156)

|

|

(737,950)

|

|

(103,739)

|

|

Other gains/(losses) – net

|

36,121

|

|

(6,631)

|

|

(932)

|

|

199,572

|

|

(415,322)

|

|

(58,385)

|

|

Total expenses

|

(9,935,922)

|

|

(11,082,267)

|

|

(1,557,920)

|

|

(26,942,919)

|

|

(32,180,896)

|

|

(4,523,919)

|

|

Profit before income tax expenses

|

5,988,458

|

|

2,111,016

|

|

296,762

|

|

19,060,534

|

|

13,616,494

|

|

1,914,176

|

|

Income tax expenses

|

(1,873,012)

|

|

(756,377)

|

|

(106,330)

|

|

(5,247,768)

|

|

(4,035,520)

|

|

(567,304)

|

|

Net profit for the period

|

4,115,446

|

|

1,354,639

|

|

190,432

|

|

13,812,766

|

|

9,580,974

|

|

1,346,872

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net profit/(loss) attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the Group

|

4,129,300

|

|

1,326,757

|

|

186,513

|

|

13,898,293

|

|

9,514,661

|

|

1,337,550

|

|

Non-controlling interests

|

(13,854)

|

|

27,882

|

|

3,920

|

|

(85,527)

|

|

66,313

|

|

9,322

|

|

Net profit for the period

|

4,115,446

|

|

1,354,639

|

|

190,432

|

|

13,812,766

|

|

9,580,974

|

|

1,346,872

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share

|

|

|

|

|

|

|

|

|

|

|

|

|

-Basic earnings per share

|

3.51

|

|

1.16

|

|

0.16

|

|

11.69

|

|

8.31

|

|

1.17

|

|

-Diluted earnings per share

|

3.31

|

|

1.16

|

|

0.16

|

|

10.91

|

|

7.97

|

|

1.12

|

|

-Basic earnings per ADS

|

1.76

|

|

0.58

|

|

0.08

|

|

5.85

|

|

4.16

|

|

0.58

|

|

-Diluted earnings per ADS

|

1.66

|

|

0.58

|

|

0.08

|

|

5.46

|

|

3.99

|

|

0.56

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LUFAX HOLDING LTD

|

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

(All amounts in thousands, except share data, or otherwise noted)

|

|

|

As of December 31,

|

|

As of September 30,

|

|

2021

|

|

2022

|

|

RMB

|

|

RMB

|

|

USD

|

|

Assets

|

|

|

|

|

|

|

Cash at bank

|

34,743,188

|

|

45,802,911

|

|

6,438,871

|

|

Restricted cash

|

30,453,539

|

|

27,021,836

|

|

3,798,670

|

|

Financial assets at fair value through profit or loss

|

31,023,211

|

|

25,564,173

|

|

3,593,755

|

|

Financial assets at amortized cost

|

3,784,613

|

|

4,749,482

|

|

667,672

|

|

Financial assets purchased under reverse repurchase agreements

|

5,527,177

|

|

–

|

|

–

|

|

Accounts and other receivables and contract assets

|

22,344,773

|

|

18,477,641

|

|

2,597,546

|

|

Loans to customers

|

214,972,110

|

|

232,229,739

|

|

32,646,340

|

|

Deferred tax assets

|

4,873,370

|

|

3,978,163

|

|

559,241

|

|

Property and equipment

|

380,081

|

|

314,618

|

|

44,228

|

|

Investments accounted for using the equity method

|

459,496

|

|

41,005

|

|

5,764

|

|

Intangible assets

|

899,406

|

|

892,068

|

|

125,405

|

|

Right-of-use assets

|

804,990

|

|

764,247

|

|

107,436

|

|

Goodwill

|

8,918,108

|

|

8,918,108

|

|

1,253,688

|

|

Other assets

|

1,249,424

|

|

1,915,345

|

|

269,255

|

|

Total assets

|

360,433,486

|

|

370,669,336

|

|

52,107,870

|

|

Liabilities

|

|

|

|

|

|

|

Payable to platform users

|

2,747,891

|

|

1,987,045

|

|

279,334

|

|

Borrowings

|

25,927,417

|

|

35,780,452

|

|

5,029,936

|

|

Bond payable

|

–

|

|

2,150,793

|

|

302,354

|

|

Current income tax liabilities

|

8,222,684

|

|

1,149,341

|

|

161,572

|

|

Accounts and other payables and contract liabilities

|

8,814,255

|

|

11,638,679

|

|

1,636,140

|

|

Payable to investors of consolidated structured entities

|

195,446,140

|

|

193,610,897

|

|

27,217,389

|

|

Financial guarantee liabilities

|

2,697,109

|

|

4,510,096

|

|

634,019

|

|

Deferred tax liabilities

|

833,694

|

|

944,792

|

|

132,817

|

|

Lease liabilities

|

794,544

|

|

764,049

|

|

107,408

|

|

Convertible promissory note payable

|

10,669,498

|

|

12,618,789

|

|

1,773,921

|

|

Optionally convertible promissory notes

|

7,405,103

|

|

8,162,603

|

|

1,147,481

|

|

Other liabilities

|

2,315,948

|

|

2,254,533

|

|

316,937

|

|

Total liabilities

|

265,874,283

|

|

275,572,069

|

|

38,739,308

|

|

Equity

|

|

|

|

|

|

|

Share capital

|

75

|

|

75

|

|

11

|

|

Share premium

|

33,365,786

|

|

25,857,702

|

|

3,635,018

|

|

Treasury shares

|

(5,560,104)

|

|

(5,642,769)

|

|

(793,248)

|

|

Other reserves

|

9,304,995

|

|

7,836,643

|

|

1,101,658

|

|

Retained earnings

|

55,942,943

|

|

65,457,604

|

|

9,201,884

|

|

Total equity attributable to owners of the Company

|

93,053,695

|

|

93,509,255

|

|

13,145,323

|

|

Non-controlling interests

|

1,505,508

|

|

1,588,012

|

|

223,239

|

|

Total equity

|

94,559,203

|

|

95,097,267

|

|

13,368,562

|

|

Total liabilities and equity

|

360,433,486

|

|

370,669,336

|

|

52,107,870

|

|

|

|

|

|

|

|

LUFAX HOLDING LTD

|

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(All amounts in thousands, except share data, or otherwise noted)

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

2021

|

|

2022

|

|

2021

|

|

2022

|

|

RMB

|

|

RMB

|

|

USD

|

|

RMB

|

|

RMB

|

|

USD

|

|

Net cash generated from/(used in) operating activities

|

1,713,184

|

|

2,368,661

|

|

332,981

|

|

5,617,033

|

|

(368,333)

|

|

(51,779)

|

|

Net cash generated from/(used in) investing activities

|

2,563,026

|

|

(5,559,517)

|

|

(781,545)

|

|

(2,635,639)

|

|

7,384,143

|

|

1,038,046

|

|

Net cash generated from/(used in) financing activities

|

(3,102,542)

|

|

4,459,025

|

|

626,840

|

|

(816,325)

|

|

(2,843,563)

|

|

(399,742)

|

|

Effects of exchange rate changes on cash and cash

equivalents

|

17,417

|

|

203,617

|

|

28,624

|

|

(44,253)

|

|

205,975

|

|

28,956

|

|

Net increase/(decrease) in cash and cash

equivalents

|

1,191,085

|

|

1,471,786

|

|

206,900

|

|

2,120,816

|

|

4,378,222

|

|

615,481

|

|

Cash and cash equivalents at the beginning of the

period

|

24,715,382

|

|

29,402,746

|

|

4,133,373

|

|

23,785,651

|

|

26,496,310

|

|

3,724,792

|

|

Cash and cash equivalents at the end of the period

|

25,906,467

|

|

30,874,532

|

|

4,340,273

|

|

25,906,467

|

|

30,874,532

|

|

4,340,273

|

View original content:https://www.prnewswire.com/news-releases/lufax-reports-third-quarter-2022-financial-results-301686199.html

View original content:https://www.prnewswire.com/news-releases/lufax-reports-third-quarter-2022-financial-results-301686199.html