SINGAPORE, Aug. 3, 2021 — Huawei on July 29, 2021 held its first virtual Asia-Pacific Intelligent Finance Summit 2021, with the theme "Accelerate Digital Transformation in Banking, New Value Together". As economies across the Asia-Pacific region continue to recover and rebound, leading banks and financial institutions are accelerating digital transformation, seizing new digitalization opportunities to reinvent themselves for what the future holds.

This event attracted more than 1,300 financial industry customers, partners, industry experts and media across Asia-Pacific regions. Huawei is honored to invite financial industry core customers and partners like BDO Unibank, KASIKORN Business – Technology Group (KBTG), PwC and IDC to participate in the panel discussion and share their experiences on how they utilize technology to upgrade the industry and range of services on offer by constructing an ecosystem that is agile and intelligent, and ultimately transform themselves into digital-capable eco-enterprises.

During the panel discussion, most of the customers mentioned that they prioritized their investment budget in technology in 2020 and 2021 and it proved that the technologies capabilities brought good business return from the investment. From the investment, customers make sure the cloud technology would bring growth in post pandemic banking through digital and ecosystem banking. In addition, in this discussion, Mr. Jarung Kiatsuphapong, CIO of KASIKORN Business – Technology Group (KBTG), said that KBTG will prioritize technology investment budgets over the next two years. Technology has proven to bring good business returns on investment.

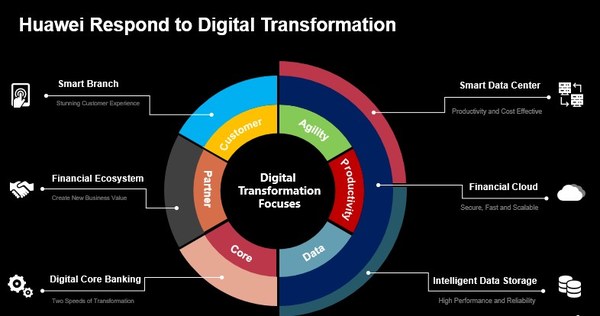

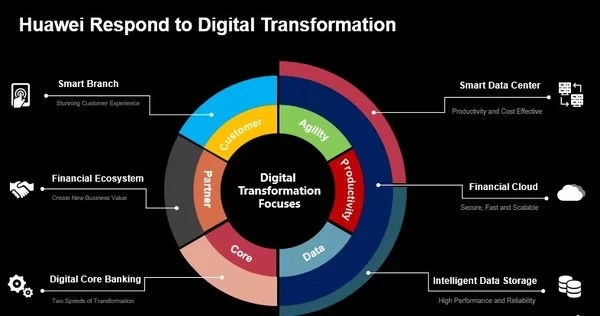

In Nicholas Ma’s, the President of Huawei Asia Pacific Enterprise Business Group opening speech, he thanked all customers and partners for their continuous support in these 10 years and future. He also mentioned that across the APAC region, Huawei has worked with over 300 leading digital ecosystem partners, to provide ICT services to over 100 financial customers. "With Huawei 6 scenario-specific solutions, including Financial Cloud, smart branch, Financial Ecosystem, Digital Core Banking, Smart Data Center, and smart Data Storage, we can help our customers make smart banking a reality and bring intelligence to finance," added in Nicholas Ma’s speech.

"Huawei has been working with the global financial industry for 10 years and has become an important partner in digital transformation for the industry. Huawei will continue to work with this industry to drive cloud-native computing to ensure financial institutions benefit from a modern and dynamic digital ecosystem that can be continually updated and developed, making use of the latest innovations. Huawei’s ethos is to help financial institutions grow into better digital ecosystem-based enterprises and develop fully connected, intelligent, and ecosystem-based finance together," Jason Cao, President of the Global Finance Business Unit of Huawei Enterprise Business Group, said in his speech.

In Eric Lin’s, CTO, Huawei Enterprise Asia Pacific Finance Account Department, presentation, he summarized that there are six important aspects for banks to focus on while designing a strategic plan of the digital transformation journey. Banks should focus on customers and partners, by enabling the digital core and data analytics capability to achieve Business Agility and Productivity. To respond to that, Eric introduced the six solutions Huawei has developed to facilitate the digital transformation from different perspectives, which are Smart Branch Solution for creating stunning customer experience for traditional customers who prefer interpersonal connection for banking service; Financial Ecosystem to create new business values for the banking customers especially for the underbanked or unbanked segment; Digital Core Banking System is the essential capability for banks to transform in two speeds, maintain the stability of the existing system, as well as publish the new banking services at FinTech speed; Financial Cloud Service, which offers banking customers a secure, fast and scalable cloud environment to try out the new solution with very minimum upfront investment; Smart Data Center including both SDN and DCI solution as well as modular Data Center, which allows customers to build the data center anywhere with lower cost; and intelligent Data Storage Solution with AI-enabled Data Management Service that is capable of managing the entire life cycle of data management to assure the banking critical services are running on the highly available and reliable platform.

For more information about Huawei Intelligent Finance Summit 2021, please visit: https://bit.ly/3BuKKSz

About Huawei

Founded in 1987, Huawei is a leading global provider of information and communications technology (ICT) infrastructure and smart devices. We have more than 197,000 employees, and we operate in more than 170 countries and regions, serving more than three billion people around the world.

Our vision and mission is to bring digital to every person, home and organization for a fully connected, intelligent world. To this end, we will drive ubiquitous connectivity and promote equal access to networks; bring cloud and artificial intelligence to all four corners of the earth to provide superior computing power where you need it, when you need it; build digital platforms to help all industries and organizations become more agile, efficient, and dynamic; redefine user experience with AI, making it more personalized for people in all aspects of their life, whether they’re at home, in the office, or on the go. For more information, please visit Huawei online at www.huawei.com or follow us on:

http://www.linkedin.com/company/Huawei

https://twitter.com/HuaweiEntAPAC

https://www.facebook.com/HuaweiEnterpriseAPAC